September 27, 2018

SBA 504 Loans vs. SBA Microloans

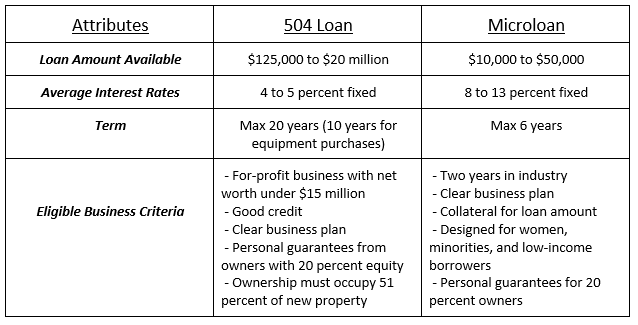

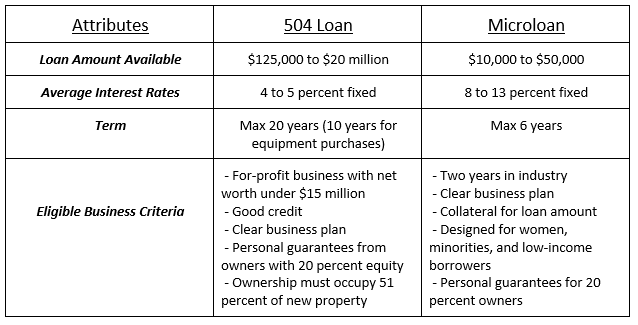

The two types of SBA loans we’ll review in this post are the 504 Loan and Microloan program. Both are low-interest financing options for small businesses, however the similarities pretty much end there. These loans have distinct eligibility requirements and the money must be used for different purposes. Keep reading to find out which one of these SBA loan options is right for your small business.

To get a 504 loan, you must have an established business with a clear plan to use the money. Because the interest rates are so low, only small businesses that are worth less than $15 million qualify. The SBA keeps competitive rates by only granting 504 loans to small companies who really need it. The cap on 504 loans is $20 million, but most don’t exceed $5 million.

Microloans are also only for small businesses, but that’s because the amounts awarded are so small. You’ll pay a higher interest rate but can borrow as little as $10,000. In addition, your personal credit score won’t be scrutinized like it would be for other types of SBA loans.

To get a 504 loan, you must have an established business with a clear plan to use the money. Because the interest rates are so low, only small businesses that are worth less than $15 million qualify. The SBA keeps competitive rates by only granting 504 loans to small companies who really need it. The cap on 504 loans is $20 million, but most don’t exceed $5 million.

Microloans are also only for small businesses, but that’s because the amounts awarded are so small. You’ll pay a higher interest rate but can borrow as little as $10,000. In addition, your personal credit score won’t be scrutinized like it would be for other types of SBA loans.

Differences Between SBA 504 Loans and Microloans

Maybe your business needs capital to fund a real estate purchase. Or, perhaps you’d like to buy a new factory to increase production, but you need $2 million to get started. In this case, a 504 loan might be a viable option. SBA 504 loans are only meant for fixed costs like real estate, equipment, or renovation of existing factories. It’s important to note that you can't use 504 money to pay off debt or purchase inventory. Since these loans are used for big expenditures, you can receive anywhere between $125,000 and $20 million. To get a 504 loan, you’ll need an intermediary called a Certified Development Company (CDC). These firms are nonprofit entities organized by the SBA to boost local business growth. From a typical 504 loan, you’d be receiving 50 percent of funds from a bank or lender and 40 percent from the CDC, with your down payment making up the final 10 percent. On the other hand, a microloan is aptly named. If your business needs a small amount of money, you won’t have to apply for the larger 504 loan. The average microloan is only $13,000, and can’t be used for real estate. Instead, you can spend microloans on working capital, inventory, and supplies. Like a 504 loan, you can’t use a microloan to pay off debts. Startups must inject 25 percent of working capital, but companies in business longer than two years only need to supply the 10 percent down payment.Eligibility Requirements For 504 Loans vs Microloans

To decide which type of SBA loan is right for your business, review the eligibility requirements for 504 loans and microloans. To get a 504 loan, you must have an established business with a clear plan to use the money. Because the interest rates are so low, only small businesses that are worth less than $15 million qualify. The SBA keeps competitive rates by only granting 504 loans to small companies who really need it. The cap on 504 loans is $20 million, but most don’t exceed $5 million.

Microloans are also only for small businesses, but that’s because the amounts awarded are so small. You’ll pay a higher interest rate but can borrow as little as $10,000. In addition, your personal credit score won’t be scrutinized like it would be for other types of SBA loans.

To get a 504 loan, you must have an established business with a clear plan to use the money. Because the interest rates are so low, only small businesses that are worth less than $15 million qualify. The SBA keeps competitive rates by only granting 504 loans to small companies who really need it. The cap on 504 loans is $20 million, but most don’t exceed $5 million.

Microloans are also only for small businesses, but that’s because the amounts awarded are so small. You’ll pay a higher interest rate but can borrow as little as $10,000. In addition, your personal credit score won’t be scrutinized like it would be for other types of SBA loans.