March 22, 2019

Meet the Major Players of Merchant Services

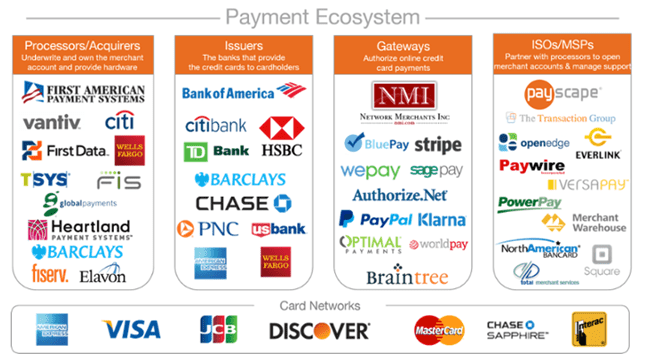

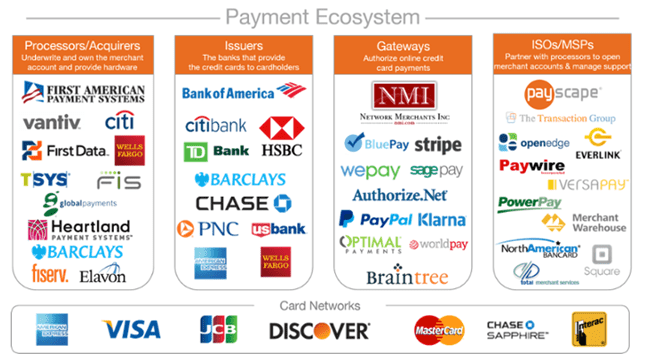

Merchant services is a broad term that refers to financial services for businesses, but it most often relates to processing services that allow merchants to accept transactions through credit and debit cards. To help you further understand, we’re going to break down the major players that make up the merchant services space.

What Are the Top Merchant Services?

1. Credit Card Associations:

First, we’ll start with credit card associations. This is a group of card-issuing banks or organizations that set common transaction terms (rules) for merchants. Some major associations are Visa, MasterCard, American Express, and Discover. These associations can offer incentives to its business members in exchange for a fee.2. Credit Card Issuing Banks:

Credit Card Issuing Banks are the banks or financial institutions that issue credit cards like Chase, Citi, Wells Fargo, etc. to consumers on behalf of card associations. The issuing bank extends a line of credit to consumers and is responsible for providing the financial backing for the transactions made with the card. Some card associations take on the role of a bank as well, developing and issuing their own cards such as, Discover and American Express.3. Payment Processor:

Payment Processors are often a third-party company appointed by a merchant to handle transactions from various channels such as credit cards and debit cards for merchant acquiring banks. They’re usually broken down into two types: front-end and back-end. According to ecommerce platforms, “a front-end processor will have a connection with various card associations and will supply settlement services and authorization to the merchant banks’ merchants. The back-end processors are used to accept the settlements from the front-end processors and move money from the issuing bank to the merchant bank.” Payment processors, also known as Acquiring Banks or Acquirers, are messengers between the merchants and credit card associations. They pass batch information and authorization requests along, so transactions can be complete. First American Payment Systems (F.A.P.S.) is the processor partnered with Payscape.4. Merchant Account Providers:

Merchant Account Providers are companies that manage credit card processing (e.g. sales, support, etc.), usually through the help of an acquirer, such as Financial Institutions, Independent Sales Organizations, or Double-Duty Acquirers depending on the situation. They give businesses the ability to accept debit and credit card payments for goods and services. This can be in-person, over the phone, or online.5. Independent Sales Organization (ISO):

Last, there’s Independent Sales Organizations (ISO), also called a Member Service Provider or MSP. This is a third-party company that is contracted by a credit card member bank to procure new merchant relationships. Small businesses benefit from ISOs since a small business owner can find it difficult to obtain a merchant account directly from acquiring banks. In these cases, ISOs can open and mange merchant accounts on behalf of the small business. Payscape is an Independent Sales Organization that markets and provides merchant services in partnership with First American Payment Systems (F.A.P.S.). We provide a one-stop shop to take care of all business owner’s financial technology needs.